SCAM 1992

- Get link

- X

- Other Apps

SCAM 1992

THE HARSHAD MEHTA STORY

A Deep Dive into the Biggest Financial Scam in Indian History

Scam 1992: The Harshad Mehta Story, a highly acclaimed web series, took India by storm when it was released on Sony LIV in 2020. Directed by Hansal Mehta, this gripping drama delves into the life of Harshad Mehta, a stockbroker who became infamous for orchestrating one of the largest financial scams in Indian history. Based on the book The Scam by Sucheta Dalal and Debashish Basu, the series sheds light on the intricate workings of the Indian stock market during the 1990s and how Mehta exploited the system for personal gain.

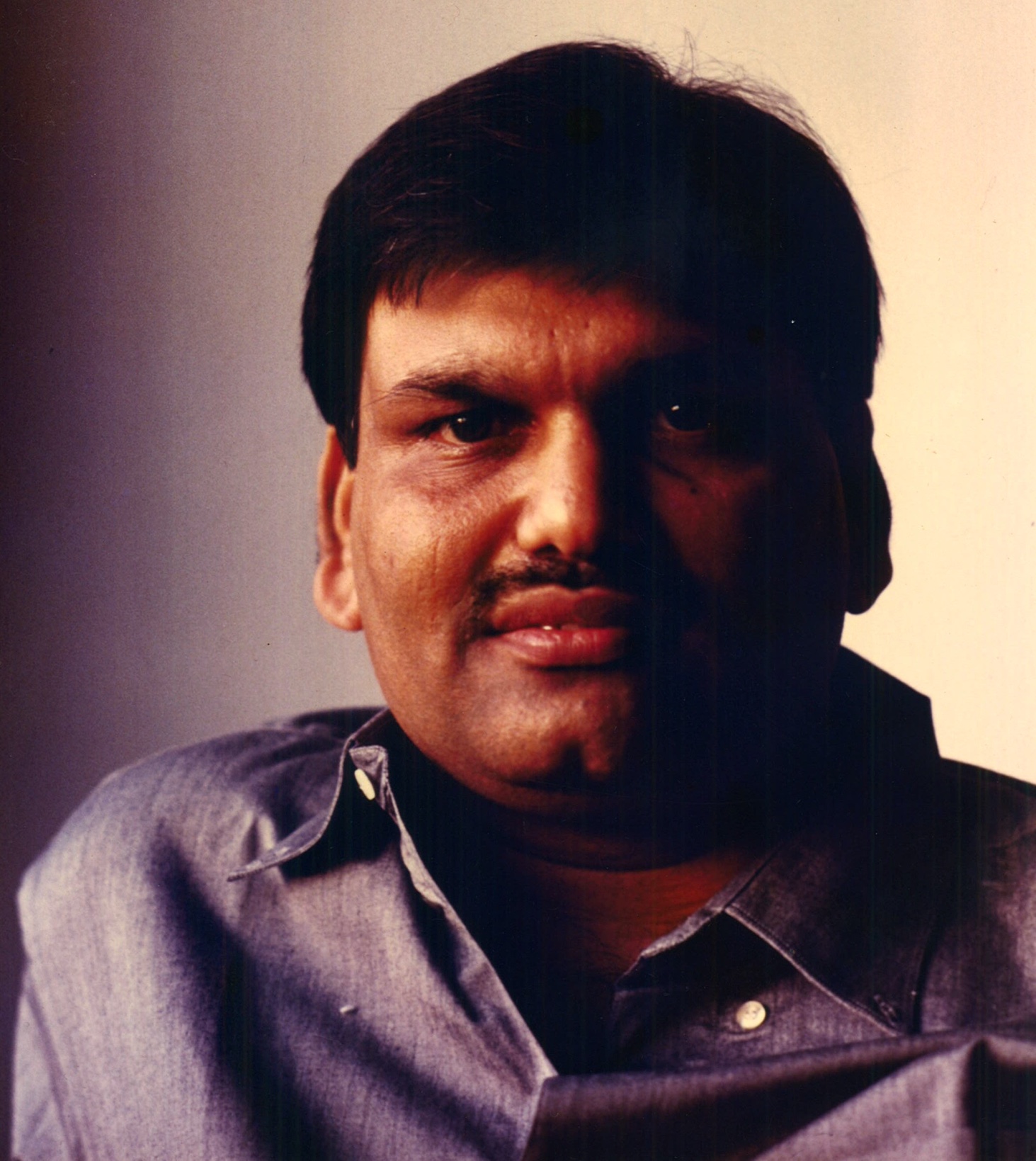

The Man Behind the Scam

Harshad Mehta, known as the “Big Bull” of the Bombay Stock Exchange (BSE), was once a rising star in the Indian financial world. With a brash and confident demeanor, he manipulated the stock market in a way that had never been seen before. At the height of his career, Mehta was adored by the media and respected by many, especially for his ability to predict stock movements and amass enormous wealth. His rise to prominence coincided with the liberalization of the Indian economy, making the stock market more accessible to the common man.

Mehta, however, had a much darker side. Behind the veneer of success was a man who exploited the loopholes in the financial system for his own benefit. The scam involved the illegal manipulation of stock prices using banks’ funds, creating a massive bubble that ultimately burst, exposing the fraud that had been going on for years.

The Mechanics of the Scam

The primary tool Harshad Mehta used to carry out the scam was the ready forward (RF) deal, a kind of short-term loan arrangement between banks and financial institutions. In this setup, Mehta manipulated the flow of money, creating fake transactions and using the funds to buy stocks at inflated prices. This created an illusion of a booming market, leading other investors to follow suit, pushing stock prices even higher.

Mehta’s key strategy involved the illegal movement of huge sums of money through fictitious transactions. He had access to a network of bankers, brokers, and politicians who turned a blind eye to his methods. By misappropriating funds from various public and private banks, Mehta created an illusion of wealth that was ultimately unsustainable.

At the time, the Indian banking system lacked adequate regulations, and Mehta exploited these gaps. His influence was so widespread that even some of the largest banks and financial institutions in the country were unable to detect the irregularities in his dealings. Mehta managed to inflate stock prices to unprecedented levels, which eventually led to a stock market crash in 1992.

The Fallout and the End of the Big Bull

The scam was exposed when journalist Sucheta Dalal, known for her investigative reporting, uncovered the illegal dealings that Mehta was involved in. She published a series of articles in The Times of India, bringing the scandal to light. The revelation shocked the nation and sent shockwaves through the financial markets.

Harshad Mehta’s empire crumbled almost overnight. The market crash triggered by his manipulation caused billions of rupees to be wiped out. As the authorities began their investigation, Mehta was arrested and charged with several offenses, including criminal breach of trust, cheating, and fraud.

Despite his initial attempts to defend himself and claim that he had merely taken advantage of a weak system, Mehta’s involvement in the scam was irrefutable. He was convicted and sentenced to prison, although he was released on bail multiple times during the long legal proceedings.

In 2001, Harshad Mehta passed away under mysterious circumstances, just when the legal proceedings were intensifying. His death added another layer of intrigue to the entire story, with many speculating that he may have been silenced before he could reveal the full extent of the scam.

The Impact of the Scam

The Harshad Mehta scam left a lasting impact on India’s financial system. It exposed the lack of regulation in the stock market and the weaknesses in the country’s banking infrastructure. Following the scam, the Securities and Exchange Board of India (SEBI) was given more power to monitor and regulate the stock market, and the Indian government introduced new laws to prevent such frauds in the future.

The scam also highlighted the need for better financial literacy among the masses. The common man, who had started investing in stocks as a result of the booming market, was left devastated by the crash. Many lost their life savings, and the trust in the stock market was severely damaged.

Scam 1992 – A Reflection of Society

What makes Scam 1992: The Harshad Mehta Story so compelling is that it isn’t just a financial drama. It is a sharp commentary on the socio-political landscape of India during the 1990s. The series offers a nuanced portrayal of ambition, greed, and the complex relationship between business and politics in the country. Harshad Mehta, as portrayed by actor Pratik Gandhi, is both a victim and a villain, a man driven by ambition but also a product of a system that encouraged such excesses.

The series also explores the ethical dilemmas faced by those around Mehta. While many were complicit in the scam, others tried to resist, and their internal conflicts are portrayed in a gripping manner. The sharp dialogues and intense performances, especially by Gandhi and the supporting cast, make it an engaging watch that holds a mirror to the socio-political dynamics of the time.

Conclusion

Scam 1992: The Harshad Mehta Story isn’t just about one man’s rise and fall; it’s about the vulnerabilities of a financial system, the consequences of unchecked ambition, and the human cost of a corrupt system. While the events took place over three decades ago, the lessons learned from the scam remain relevant to this day, especially in terms of financial regulation and market ethics.

As a piece of storytelling, the series is a triumph, blending historical facts with captivating drama to shed light on one of the most shocking financial scandals in Indian history. Whether you're a finance enthusiast or someone who simply enjoys a well-crafted narrative, Scam 1992 offers a thrilling, thought-provoking journey into the world of high-stakes finance.

- Get link

- X

- Other Apps

Comments

Post a Comment